Malaysian F&B Manufacturers Pivot to Solar: Cost Control Meets Sustainable Mandates

TL;DR

- Malaysian Food and Beverage (F&B) manufacturers are aggressively adopting solar power due to escalating electricity costs and increased Environmental, Social, and Governance (ESG) mandates.

- Rising energy costs, with 41% of manufacturers reporting increases up to 10% in 2023, necessitate cost stabilization strategies.

- Companies like K.H.H. Double Lion, in partnership with EFS Group, demonstrate that solar can generate around 40% of production floor electricity, securing cost predictability.

- Government initiatives like the new Solar Accelerated Transition Action Programme (Solar ATAP) replace the previous Net Energy Metering (NEM) scheme, offering incentives to accelerate the transition to renewable energy.

Introduction: The Dual Pressure Driving Industrial Change

A quiet but profound revolution is transforming Malaysia’s industrial landscape, particularly within the Food and Beverage (F&B) manufacturing sector. This seismic shift is being driven by the strategic convergence of two major external forces: relentless surges in electricity costs and the growing, non-negotiable global mandate for sustainability and Environmental, Social, and Governance (ESG) compliance. Renewable energy has rapidly transitioned from a philanthropic corporate responsibility initiative to an essential component of competitive operational strategy.

Recent data from the Federation of Malaysian Manufacturers (FMM) underscores the severity of the challenge, indicating that 41% of manufacturers reported energy cost increases of up to 10% in 2023. For businesses operating on characteristically thin margins, these dual pressures—rising costs and escalating environmental expectations—are compelling a fundamental and urgent rethinking of energy strategy. Solar energy, once regarded as a premium environmental gesture, is swiftly becoming the pragmatic and necessary choice for manufacturers seeking to future-proof their operations and secure their competitive position.

Securing Predictable Operating Costs

The financial argument for solar adoption is now irrefutable, especially within the cost-sensitive F&B industry. Manufacturers face persistent volatility in energy prices, which directly impacts their profitability and stability.

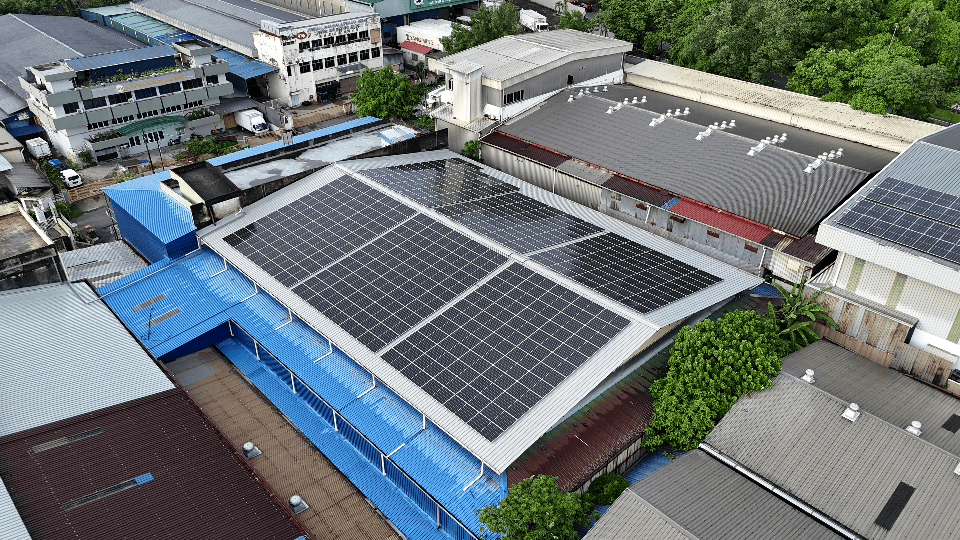

ShutterstockK.H.H. Double Lion Fruit Juice Manufacturing Sdn. Bhd., a prominent beverage producer with a 50-year history, exemplifies this strategic pivot. By partnering with renewable energy solutions provider EFS Group to install comprehensive solar panels across its facility, the company delivered immediate and long-term value. Karin Tan, Director of K.H.H. Double Lion, articulates the necessity: “Energy costs were climbing every quarter… Solar stopped being a ‘nice to have’ and became essential to staying in the game. Solar has helped us generate about 40% of electricity to help support our production floor.”

This transition not only provides crucial insulation against energy price fluctuations but also locks in predictable operating costs, which is a decisive advantage in a hyper-competitive market. Darren Tan, CEO of EFS Group, affirms this industry-wide shift, noting: “Today, it’s about securing predictable energy costs, meeting buyer requirements, and future-proofing operations against an uncertain energy landscape.”

Sustainability as a Market Imperative

Beyond cost management, the increasing stringency of ESG mandates is redefining market access. Global supply chains are realigning in response to climate commitments, meaning Malaysian manufacturers must demonstrate credible progress on their carbon footprint. Buyers demand proof, investors require transparency, and businesses that fail to demonstrate sustainability credentials risk exclusion from lucrative, climate-conscious markets.

The decision to adopt solar power therefore serves a dual purpose: it stabilizes margins while simultaneously strengthening credentials with sustainability-conscious buyers. This strategic move positions early adopters not simply as environmentally conscious, but as highly adaptable and strategically prepared for a market that is projected to increasingly penalize carbon-intensive operations.

Policy Acceleration and New Incentives

The pressures facing individual businesses are mirrored by Malaysia’s broader national commitment to energy transformation. The National Energy Transition Roadmap (NETR), launched in 2023, sets ambitious targets, aiming to increase renewable energy capacity from approximately 25% today to 31% by 2025. This roadmap forecasts economic opportunities valued at up to RM 1.3 trillion through 2050.

To accelerate industrial adoption, the government has introduced concrete incentives. Effective December 1st, the Solar Accelerated Transition Action Programme (Solar ATAP) replaces the previous Net Energy Metering scheme. Solar ATAP retains the core principle of allowing users to sell excess energy back to the grid but incorporates adjustments designed to optimize adoption. The program permits solar system installations of up to 100% of maximum demand, enabling users to maximize self-consumption while offsets are calculated at the System Marginal Price (SMP).

For existing users whose NEM offset periods have concluded, the government offers alternative pathways, including switching to programmes like Solar for Self-Consumption (SelCo) or the Community Renewable Energy Aggregation Mechanism (CREAM), or the strategic installation of energy storage systems. These policy movements represent a fundamental recalculation of how Malaysia positions its industrial sector in an increasingly carbon-conscious global economy.

The Competitive Imperative for Action

The transformation within Malaysia’s F&B sector demonstrates a clear industrial awakening: profitability and planet protection have become inseparable. Energy stability preserves margins, while verifiable sustainability credentials unlock new markets and satisfy investors.

The experience of K.H.H. Double Lion proves this transition is achievable for established manufacturers of any size. For the entire F&B sector, the urgency is palpable, especially with Malaysia targeting 40% renewable energy in the power mix by 2035. The critical question for manufacturers is no longer whether to embrace solar, but how swiftly they can integrate it into long-term operational planning. Companies that move decisively now secure favorable financing and partner with experienced integrators to define the competitive standards of tomorrow’s resilient industrial landscape. Those who delay risk finding themselves at a significant and mounting disadvantage.