Account Labs Raises USD7.7M and Unveils UniPass Wallet App with Google Login

Account Labs, a Web3 wallet solution provider, has successfully raised USD7.7 million from prominent investors like Amber Group, MixMarvel DAO Ventures, and Qiming Ventures. Alongside this fundraising, Account Labs is launching its consumer-oriented app, UniPass Wallet, on the Polygon network. This innovative wallet leverages account abstraction to allow users to create and log in to a self-custody Web3 wallet using just their Google account and easily top up using Mastercard or Visa cards. The goal is to provide a seamless and user-friendly crypto finance experience.

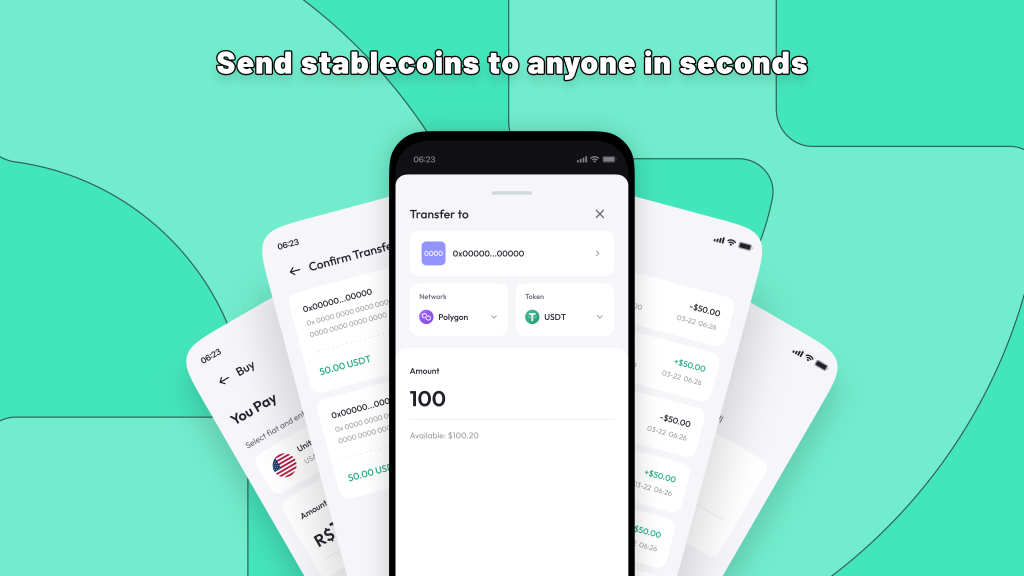

Account Labs was created through the merger of Keystone, a hardware wallet developer, and UniPass, a software wallet developer, in May 2023. Their first offering, the UniPass Wallet app, is aimed at driving mass crypto adoption through peer-to-peer (P2P) stablecoin transfers. The initial launch and testing phase of the UniPass Wallet app will focus on the Philippines, a region with high crypto adoption rates. However, the app is accessible globally, following the ethos of decentralized finance and does not require users to complete KYC (know your customer) procedures.

UniPass Wallet

The UniPass Wallet app’s ease of use and the increasing popularity of stablecoins make it suitable for peer-to-peer transfers, especially in regions with slow and costly cross-border remittances. By improving financial access and inclusion, Account Labs contributes to the original goals of cryptocurrencies. Account abstraction is a key enabler for these objectives, allowing developers to integrate more functionality directly into wallets, simplifying the user experience.

“Due to the wallet’s ease of use and the eponymous stability of stablecoins, UniPass is addressing the real-life everyday use case of P2P transfers, especially in emerging markets where cross-border remittances are slow and expensive. Expanding financial access and inclusion has been the goal of cryptocurrencies since day one, and account abstraction is critical to achieving that goal,”

said Lixin Liu, CEO of Account Labs.

Account Labs is dedicated to bringing Web3 and cryptocurrencies to the mainstream, and the UniPass Wallet app is a pivotal step in this direction. Users don’t need to grapple with complex seed phrases; they can use their Google account to set up and access their Web3 wallet. Additionally, the UniPass Wallet allows users to top up their account with cards, Apple Pay, or popular mobile wallet apps, like GCash in the Philippines. These stablecoins can then be sent directly to other Web3 wallets. The transaction fees are extremely low, with costs as low as 1 or 2 U.S. cents per transaction. The self-custody nature of UniPass Wallet ensures that users have complete control over their funds in a decentralized and trustless environment.

The UniPass Wallet app will launch on Polygon, also available soon on Android and iOS support planned for the future. Account Labs envisions further expansion to Apple ID and other social media logins to enhance accessibility. Account Labs, with the support of the Ethereum Foundation, has been at the forefront of developing account abstraction, a technology that simplifies the user experience and fosters the mass adoption of cryptocurrencies.

In addition to account abstraction, Account Labs recognizes the importance of stablecoins in driving crypto adoption. Stablecoins, backed by fiat currencies, provide a level of trust that makes them easier for non-crypto enthusiasts to embrace. The UniPass Wallet app has the potential to revolutionize the way users access cryptocurrency-based financial services, making it easier, more affordable, and more accessible.

Account Labs, with the launch of the UniPass Wallet app, embodies the true spirit of Web3 by promoting financial inclusion and access. The application addresses the need for low-cost, instant, cross-border transfers, which have become increasingly important as traditional financial systems face challenges like inflation and currency volatility. UniPass Wallet seeks to fill the gap left by traditional finance in providing these crucial financial services, especially for emerging markets.