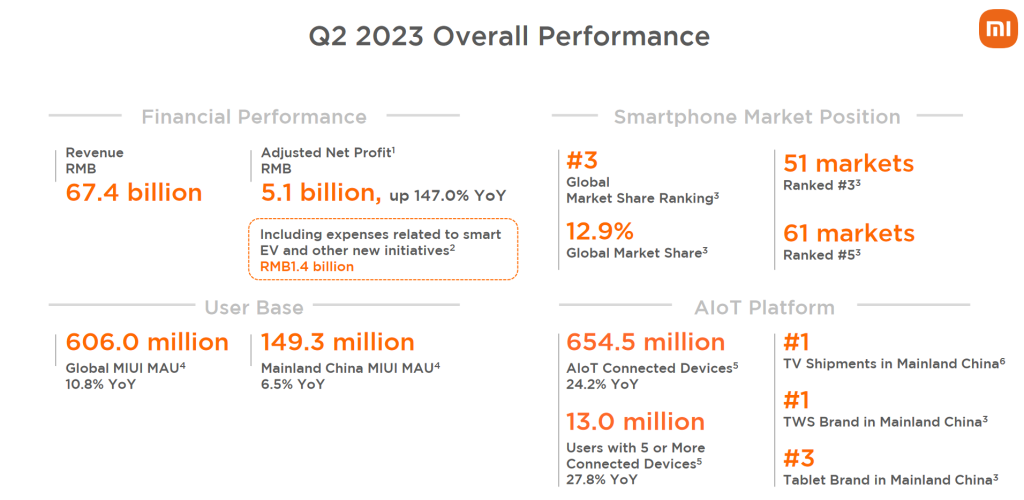

Xiaomi Corporation (“Xiaomi” or the “Group”; stock code:1810), a consumer electronics and smart manufacturing company with smartphones and smart hardware connected by an Internet of Things (“IoT”) platform at its core, announced its unaudited consolidated results for the three months ended June 30, 2023 (“2023 Q2” or “the Period”). Since the execution of key corporate strategy of “dual emphasis on scale and profitability” two quarters ago, Xiaomi has achieved robust profit and business growth with multiple operating metrics hitting historical highs. In the second quarter of 2023, Xiaomi’s total revenue reached RMB67.4 billion (approx. RM43 billion), representing a quarter-on-quarter (“QoQ”) growth of 13.2%. The adjusted net profit reached RMB5.1 billion (approx. RM3.2 billion), a year-on-year (“YoY”) growth of 147.0%. This marks the highest quarterly profit since the fourth quarter of 2021, far exceeding market consensus. In the first half of 2023, Xiaomi’s adjusted net profit reached RMB8.4 billion (approx. RM5.4 billion), nearing the level of last year’s adjusted net profit.

During the Period, Xiaomi continued to execute its key corporate strategy and has steadily advanced its smartphone premiumization strategy. The Group’s gross profit margin reached a record high of 21.0%, marking an improvement in the gross profit margins across all three business segments, including smartphones, IoT and lifestyle products and internet services. In addition, Xiaomi has been actively improving internal efficiency and overall performance. It also continued to reduce costs, enhance efficiency, and further optimized inventory management measures, further consolidating the Group’s long-term and sustainable development. During the quarter, the Group’s overall expenses were RMB10.2 billion (approx. RM6.5 billion), down 2.3% YoY. Its total inventory was RMB38.5 billion (approx. RM24.6 billion), down 33.5% YoY, hitting its lowest level in the past ten quarters. The aggregate amount of cash resources of the Group reached a new record high of over RMB113.2 billion (approx. RM72.4 billion). The abundant cash resources further demonstrate that Xiaomi is equipped with a healthy and efficient operating model, fortifying the foundation for future development.

Gross profit margin of smartphone business set new high, driven by the solid momentum of premiumization strategy

Amid continuing soft demand in the global smartphone market, Xiaomi has persistently evolved to take the reins and seize opportunities. According to Canalys, Xiaomi’s global smartphone market share increased by 1.6 percentage points to 12.9% QoQ, with its global smartphone shipments amounted to 32.9 million units. In the second quarter of 2023, its smartphone revenue reached RMB36.6 billion (approx. RM23.5 billion), up 4.6% QoQ. The gross profit margin of its smartphone business reached 13.3% this quarter, an increase of 4.7 percentage points YoY, setting a record high.

According to Canalys, in the second quarter of 2023, Xiaomi’s smartphone shipments ranked in the top three across 51 countries and regions globally and ranked in the top five across 61 countries and regions globally. The Group’s smartphone shipment ranking rose to No. 2 in both Europe and the Middle East markets, further solidifying its leadership position in the overseas market.

Xiaomi continued to harness its competitiveness in cutting-edge technologies in the premium smartphone segment. In August, Xiaomi unveiled the Xiaomi MIX Fold 3 in mainland China. In the first five minutes after hitting the shelf, the sale of Xiaomi MIX Fold 3 reached 2.25 times of its last generation, setting a new record for the Group’s foldable smartphones. According to third-party data, in the second quarter of 2023, Xiaomi’s smartphone units sold in the RMB4,000–RMB6,000 price segment in mainland China garnered a market share of 12.7%, a YoY increase of 6.2 percentage points. Moreover, Xiaomi’s smartphones priced at or above RMB3,000 sold as a percentage of the Group’s overall units sold in mainland China reached an all-time high, experiencing consecutive YoY growth for four consecutive quarters. In the second quarter of 2023, the average selling price (“ASP”) of Xiaomi smartphones in mainland China also increased by over 24% YoY.

IoT segment continued to grow, with revenue from smart large home appliances revenue surging by more than 70%

With the unveiling of policy incentives to enhance market demand and boost consumption, Xiaomi’s revenue from our IoT and lifestyle products was RMB22.3 billion (approx. RM14.3 billion), an increase of 12.3% year-over-year, and its gross profit margin reached 17.6%, up 3.3 percentage points year-over-year, setting a new record high.

Xiaomi continued to strengthen the interconnectivity in various user scenarios. As of June 30, 2023, the number of connected IoT devices (excluding smartphones, tablets and laptops) on the Group’s AIoT platform reached 654.5 million, an increase of 24.2% YoY. The number of users with five or more devices connected to the Group’s AIoT platform (excluding smartphones, tablets, and laptops) reached 13.0 million, representing a YoY increase of 27.8%. In June 2023, the monthly active users (“MAU”) of the Mi Home App grew to 82.9 million, an increase of 17.1% YoY.

During the Period, revenue from smart large home appliances (including air conditioners, refrigerators, and washing machines) surged by more than 70% YoY. Among them, Xiaomi’s air conditioner shipments increased by over 90% YoY. Both of the Group’s refrigerator and washing machine businesses outperformed the market. Its refrigerator shipments exceeded 500,000 units and its washing machine shipments exceeded 300,000 units. According to All View Cloud (“AVC”), in the first half of 2023, Xiaomi TV shipments ranked No. 1 in mainland China.

Internet ecosystem continued to thrive with various operating metrics hitting record high

Xiaomi’s global internet user base continued to expand. The MAU of MIUI globally and in mainland China, as of June 2023, reached 606.0 million and 149.3 million respectively, registering a YoY increase of 10.8% and 6.5%. In the second quarter of 2023, Xiaomi’s internet services revenue was RMB7.4 billion (approx. RM4.7 billion), an increase of 6.8% YoY, hitting a quarterly record high, while the gross profit margin of its internet services reached 74.1%.

In the second quarter of 2023, Xiaomi’s advertising revenue reached RMB5.1 billion (approx. RM3.3 billion), an increase of 13.0% YoY, setting a record high. Revenue from both domestic and overseas performance-based and brand advertising also registered new quarterly highs. Xiaomi’s gaming revenue reached RMB1.0 billion (approx. RM639 million), an increase of 7.5%, enjoying YoY growth for the eighth consecutive quarter.

In terms of overseas internet services, Xiaomi maintained an open and positive approach to partnership opportunities worldwide. In the second quarter of 2023, Xiaomi’s revenue from overseas internet services increased 19.7% YoY to RMB2.0 billion (approx. RM1.3 billion), hitting a record high, accounting for 26.8% of total internet services revenue, up 2.9 percentage points YoY.

R&D strategy upgraded with more than 3,000 top-tier AI professionals

Since the start of this year, the global technology industry has been swept by an artificial intelligence (“AI”) boom. In fact, Xiaomi is among the pioneering mainland enterprises making aggressive inroads into the realm of AI. From establishing its first visual AI team in 2016, Xiaomi’s AI team has expanded six times in seven years to more than 3,000 top-tier AI professionals. The Group has gradually established its AI capabilities in areas such as visual, audio, acoustics, knowledge graphs, Natural language processing (“NLP”), machine learning, multimodal AI, among others.

Xiaomi’s self-developed large language model (“LLM”) has officially been unveiled. On August 10, 2023, Xiaomi’s 6 billion-parameter self-developed large language model ranked No. 1 on the C-EVAL list among peer models with same-level parameters and ranked No. 1 on the CMMLU list of Chinese-language large language models. In terms of the future LLM deployment direction, Xiaomi will focus on ‘lightweight and local deployment’, seeking to balance the efficiency and effectiveness, rather than blindly pursuing parameter size. Xiaomi has empowered its intelligent voice-based AI Assistant (“小愛同學”) with large language models, and have started invitation-based testing.

In the second quarter of 2023, Xiaomi’s R&D expenses reached RMB4.6 billion (approx. RM2.9 billion), up 21.0% YoY. Xiaomi expects its R&D investment will exceed RMB100 billion (approx. RM63.9 billion) during the five years between 2022 to 2026.